By, Aida Mokhtar

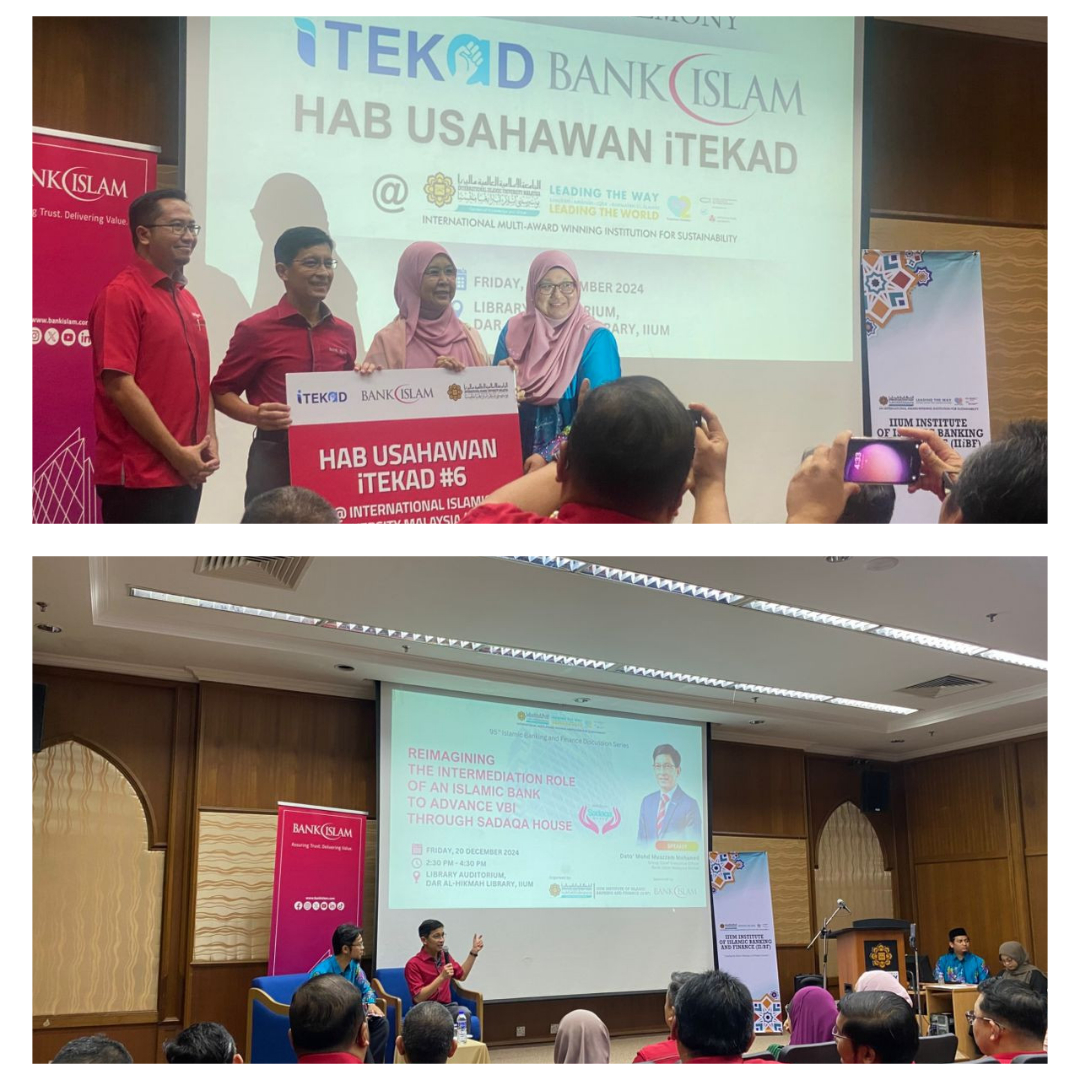

GOMBAK, 23 December 2024: It was a day that highlighted a major achievement from the collaboration of IIUM Institute of Banking and Finance (IIiBF) and Bank Islam with the launch of the sixth iTekad Entrepreneur Hub in conjunction with the 95th Islamic Banking and Islamic Finance discussion series. The launch organised by IIiBF, took place on 20 December 2024 at the International Islamic University Malaysia (IIUM) Gombak.

The event themed, ‘Reimagining the Intermediation Role of Islamic Bank to Advance VBI through Sadaqa House,’ marked the attendance of prominent guests from Bank Islam, its Group Chief Executive Officer cum President of the Association of Islamic Banking and Financial Institutions of Malaysia and IIUM alumnus, Dato’ Mohd Muazzam Mohamed, other Bank Islam staff members and IIUM students.

The launch and significant milestone commenced with the welcoming remarks by the Dean of IIiBF, Prof. Datin Dr. Rusni Hassan who mentioned that the discussion series is part of IIiBF’s efforts in giving back to the community as khalifah or vicegerents, “We support IIUM initiative to give (back) to the ummah.” She also conveyed IIiB’s 20 year old birthday in 2025 which is another prominent milestone.

She claimed that IIiBF has 50 collaborators for its programmes with whom it shares values and beliefs with. IIiBF is an institute that is a collaboration of three kulliyyahs: Kulliyyah of Economics and Management Sciences (KENMS), Ahmad Ibrahim Kulliyyah of Laws (AIKOL) and AbdulHamid AbuSulayman Kulliyyah of Islamic Revealed Knowledge and Human Sciences (AHAS KIRKS). IIiB has achieved significantly as Prof. Datin Dr. Rusni shared with the audience on the awards won by IIiBF in 2024. It was awarded Best Islamic Finance Research Firm at the Islamic Finance News Awards 2024 (IFN Awards 2024) and Best Kulliyyah Award (Research & Innovation) Social Sciences during IIUM’s Responsible Research and Innovation Appreciation Day 2024 (RRIAD 2024). IIUM also won an IFN 2024 Award for Best Educational Institution offering Islamic Finance courses – such commendable accomplishments!

According to the Dean, IIiBF would like to do more impactful programmes with the help of Dato’ Muazzam; their collaboration has given birth to iTekad which is about financial inclusion leading to baraqah through sadaqah. iTekad is a Shariah-compliant social finance programme combining Islamic banking practices with philanthropic instruments, such as zakat and waqf, mentions IIiBf’s media statement.

Dato’ Muazzam narrated to the audience the story of how the iTekad programme was born. He brought the audience through the evolution of Islamic finance that is in its third phase that started 20 years ago with Tabung Haji whose spirit of helping pilgrims so that they did not return from hajj poor but saved their money first before embarking on hajj. According to Tabung Haji (https://www.tabunghaji.gov.my/ms/korporat/informasi-korporat/tentang-kami), it was established in 1962 based on an idea proposed by Profesor Diraja Dr. Hj. Ungku Abdul Aziz bin Ungku Abdul Hamid in December 1959 to the Federation of Malaya.

“The beauty of Islamic finance after 41 years old (with the establishment of the first Islamic bank, Bank Islam in 1983) is that it has become mainstream,” said Dato’ Muazzam. He said there are at present more than 20 Islamic banks in Malaysia with some banks such as Bank Islam and Bank Muamalat known as full-fledged Islamic banks. The fourth governor of Malaysia’s central bank (Bank Negara Malaysia), Tan Sri Jaffar Hussein in 1990 introduced the dual banking system encompassing conventional and Islamic banking systems and wanted to see Islamic finance thrive through a solid regulatory structure.

In 1993, Islamic banking was promoted as banking without interest translated to tanpa faedah which was not well-received as it literally meant ‘without benefits.’

“We want to save the ummah by offering banking products that met Shariah principles,” he said. It was apparent that there was confusion between conventional and Islamic finance and the industry needed to do some soul searching. The basis of Islamic finance according to Dato’ Muazzam, was to help people get a good life and this objective when associated with banking and finance was untapped which was an opportunity for Bank Islam as finding a niche that went beyond Islamic contracts was essential leading to the sadaqah model.

“There was the strength of the sadaqah model and then the founding of the Sadaqa House. If we did not tap into this then we cannot do what we are doing now,” said Dato’ Muazzam. The idea of the Sadaqa House was proposed by the Royal Award winner of Islamic Finance 2014 and founding father of Islamic finance and the first managing director of Bank Islam, late Datuk Dr. Abdul Halim Ismail. According to Bank Islam, Sadaqa House Bank Islam was first launched it in 2018 (https://www.bankislam.com/corporate-info/social-finance-bank-islam/sadaqa-house-bank-islam/). It serves as a hybrid between technology and Shariah solutions and is a social finance platform that matches donors and change-makers and beneficiaries in an inclusive Islamic economic ecosystem, which it calls ‘the new narrative.’ There is also Sadaqa House Orphan Fund that collects donations, distributes 50 percent and invests 50 percent of the amount for future distribution to orphans. It was launched on 22 May 2022, according to Bank Islam (https://www.bankislam.com/corporate-info/social-finance-bank-islam/sadaqa-house-orphan-fund/).

The idea of helping the poor fish by providing education on entrepreneurship is one of the efforts of Bank Islam that advocates the notion of financial inclusion. As such, the iTekad micro financing programme was developed and launched in May 2020. According to Bank Islam’s press release, it is, “a social finance initiative to support sustainable income generation and financial resilience of asnaf and B40-owned micro- enterprises in the current challenging landscape.” Another Bank Islam programme, iTekad Bangkit provides funding for the needy who would like to become entrepreneurs. The programme also provides practical entrepreneurship training and mentoring that is the recipe for success, said Dato’ Muazzam as he prides in the fact that the default rate is at three percent that is better than the small medium enterprise banking default rate in Malaysia. iTekad involves collaborations with IIiBF, trading associations and other stakeholders.

“Our hope through the Hub Usahwan iTekad is the ability for us to coach, mentor and train (future entrepreneurs),” mentioned Dato’ Muazzam. Bank Islam is interested in the impact, prospective turnover, empowering women with the focus on upward mobility. The CEO mentioned that there is the opportunity for upcoming entrepreneurs to graduate from the iTekad programme and qualify for a commercial banking portfolio.

An interesting part of the iTekad programme is to see the real impact on people’s lives as the CEO recalled the story of a woman who was laid off from her job at a factory who then had to stay at a bus station with her family. She also found out she had breast cancer at the time and she eventually got to know about Bank Islam’s iTekad programme. She applied for it and has been able to make a living and obtain a home for her family ever since.

The formal launching ceremony of Hub iTekad Usahawan ensued after the CEO’s speech and a dialogue session with the audience. The hub is where upcoming entrepreneurs can learn of business strategies, digital marketing and other essentials of setting up and running a business. IIUM Today wishes all the best to IIiBF and Bank Islam! May you both prosper!***

- UTCC and IIUM Sign Historic MoU Fostering Closer Relations - August 8, 2025

- Happy Mother’s Day from IIUMToday - May 12, 2025

- IIUM Rector Launches ‘Support our Special Podcast’ in Special Eid Celebration - April 24, 2025