By Ameerah Angelina

GOMBAK, 22 December 2021: Islamic banking and finance need to have relevant products that are meant to benefit humankind, value chain financing, good mainstreaming inside financial policies, personalised solutions, and good luck to prosper in the future.

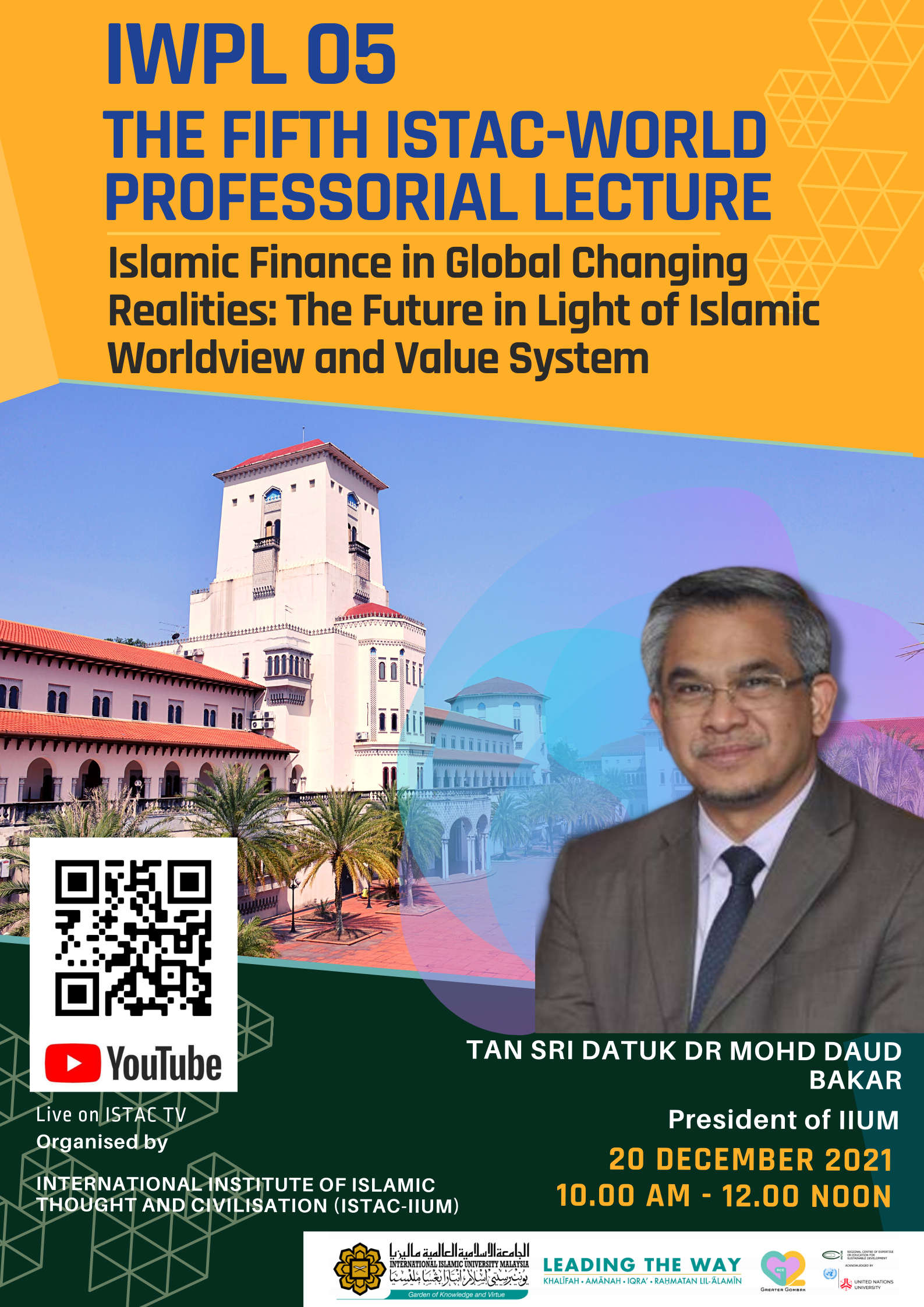

These are the five elements shared by IIUM President, Tan Sri Datuk Dr. Mohd Daud Bakar, when asked about the future of Islamic finance at the Fifth ISTAC-World Professorial Lecture (IWPL 05).

Organised by the International Institute of Islamic Thought and Civilisation (ISTAC-IIUM), this fifth lecture titled œIslamic Finance in a Global Changing Realities: The Future in Light of Islamic Worldview and Value System was held on Zoom and live-streamed on YouTube on Monday (20 December).

The event hosted by Prof. Dr. Abdelaziz Berghout, Dean of ISTAC IIUM and moderated by Prof. Mohamed Aslam Haneef, had drawn a total of 292 views on YouTube.

Aimed at looking at the Islamic finance in a wider context of global realities, and how Islamic finance needs to proceed from a wider base of the Islamic worldview and value system with the end goal of creating a new narrative, the event had invited Dr. Mohd Daud Bakar, a distinguished scholar who combines theoretical and practical aspects with his vast knowledge and experiences in Islamic finance.

The lecture was broken down into four segments with the first talking about how people must not place exceeding expectations and hopes on Islamic finance to solve all their problems because “over hope will kill as well, so we need to be proportionate, said Dr. Mohd Daud Bakar.

œWe need to be governed by the data and epistemology of the knowledge, not by intuition, whim emphasis, or personal preference of our own thoughts and perspective, he added.

Furthermore, he also shared his theory of wealth circulation and resharing, emphasising that Islamic finance is not all about resharing and the importance of debt management as the vertical of growth or crisis.

The second segment talked about the global changing realities in which he said that œrealities are not to be discussed, but to be internalised, including in the curriculum”.

Despite the common demand and supply theory that the world tends to follow, he stressed that œIn Islam, we should be in the position to provide the supply before the demand.

Thus, it is important to create and supply quality products that will greatly benefit the people in order for there to be demand, the President said.

This is in relation to the value system and Islamic worldview, which he shared in the third segment in which he placed the need to differentiate between the divine and the interpretation of the divine.

œIslamic worldview refers to how we think and process the data weve read and been exposed to, and the whole purpose of revelation is to build a life on this planet, he told the audience.

œThe Islamic value system is about putting the new value that, in my perspective, is fixed and permanent but the boundaries of the value are not permanent.

œWe need to give new dosage to the meaning of amanah and integrity; the meaning of being able to supply more than the demand.

Even so, he argued that the challenge to this is that œMalaysia is still a very feudalistic society.

œSo, the value system needs to move away from a very high-end up and focus on levelling the field to create more value to those who work hard, offer great employment to the society and create the value chain of the whole economy.

He said that these are the issues Islamic banking and finance need to be able to address as soon as possible.

In order to do well in the future, Islamic banking and finance need to have the five good vertices mentioned earlier to stay relevant, functional and impactful to society.

œWe need to infuse intelligently and diligently the financial product and the broad policies of the country and government by taking a look at the impact when issuing a product and putting value into the technology, marketing, packaging, narrative and system delivery to create value chain financing, he shared.

œIslamic finance has not been involved very strongly in this aspect and the value chain cannot only create more value to the economic output but also create more employment and sustainable community development in society.Â

In addition to this, Islamic finance also needs good mainstreaming by working with other bigger world organisations to create shariah-compliant carbon credits as well as other assets, and to come up with personalised solutions to cater to each and everyone in the society who all have different needs.

The very last element needed, according to him, is good luck and du’a.

Overall, this event was informative and had successfully shed light on the future of Islamic finance in the global realities pertaining to the Islamic worldview and value system.Â

The live stream has been saved on YouTube and can be watched here.***