By Norashikin Azizan

GOMBAK, 8 March 2019 – Three main ideas were raised at the recent talk titled “Business of Banking: Money Creation and Fractional Reserve Banking” in relation to ‘what is business banking’, ‘what is the real business banking’ and ‘the war on Riba’.

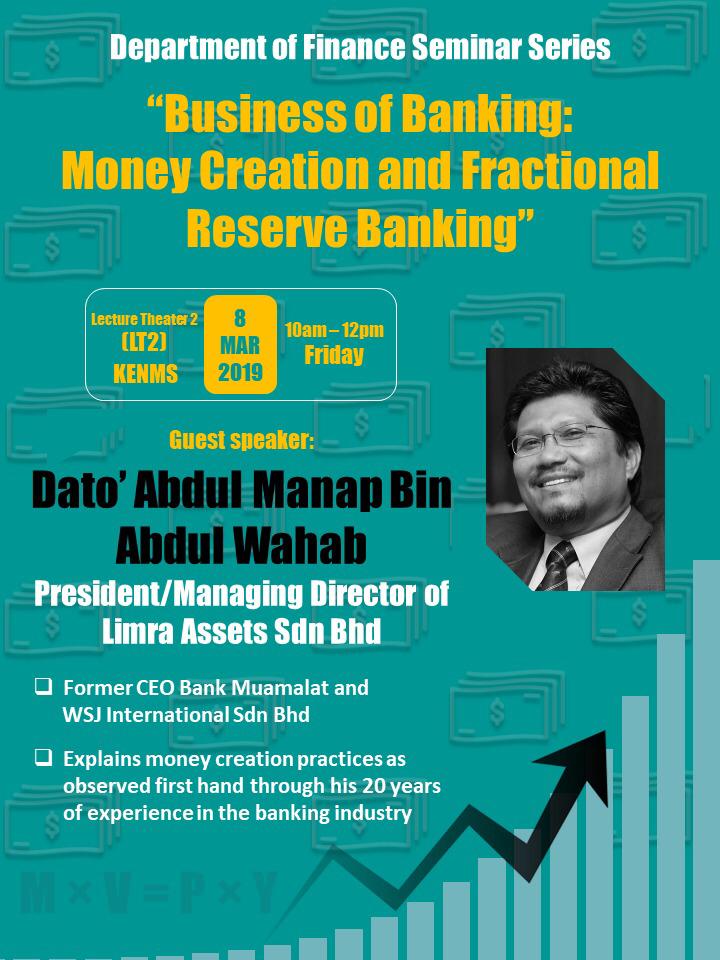

The President and Managing Director of Limra Assets Sdn. Bhd, Dato Abdul Manap bin Abdul Wahab, explained that the process of money creation has been the practice of banks in order to increase money supply, and it is important to master the know-how of fractional reserve banking.

As a guest speaker, Dato’ Abdul Manap was also the former Chief Executive Officer (CEO) of Bank Muamalat and WSJ International Sdn. Bhd.

Elaborating on the distinction between Islamic banks, trades and Riba banks, Dato Abdul Manap felt that Islamic banks do adopt the concept of Riba since the item of exchange is money, similar to conventional banks.

On the other hand, Dato’ Abdul Manap said, a trade does not involve money as the item of exchange, therefore, there should be no instances of Riba. (In surah Ali-Imran verse 160-161, Allah forbids the practice of Riba as it will cause destruction rooting from greed.)

œHenceforth, it is important for a Muslim to familiarise oneself with the knowledge in financing as to live rightfully, Dato Abdul Manap emphasised.

The business of banking in Malaysia has been a broad-based industry and it is one of the major catalysts to maintain our countrys economy.

After Islamic banking was introduced in 1963, banks in Malaysia operate mainly in two ways – conventional and Islamic. Both methods are of paramount importance in the creation of money and fractional reserve banking.

The talk held on Friday (8 March) by the Department of Finance was one of the seminar series organised by the department. It took place in Lecture Theatre 2, Kulliyyah of Economics and Management Sciences (KENMS).

The event was aimed at getting a clear illustration of money creation practices as observed first-hand through the guest speakers two decades of experiences in this field of work. It was also to elucidate the distinctiveness of Islamic banking and conventional banking practised in Malaysia.

The two-hour event was participated by lecturers and students from their respective classes and ended at around 12 noon after a very insightful Question and Answer session.***